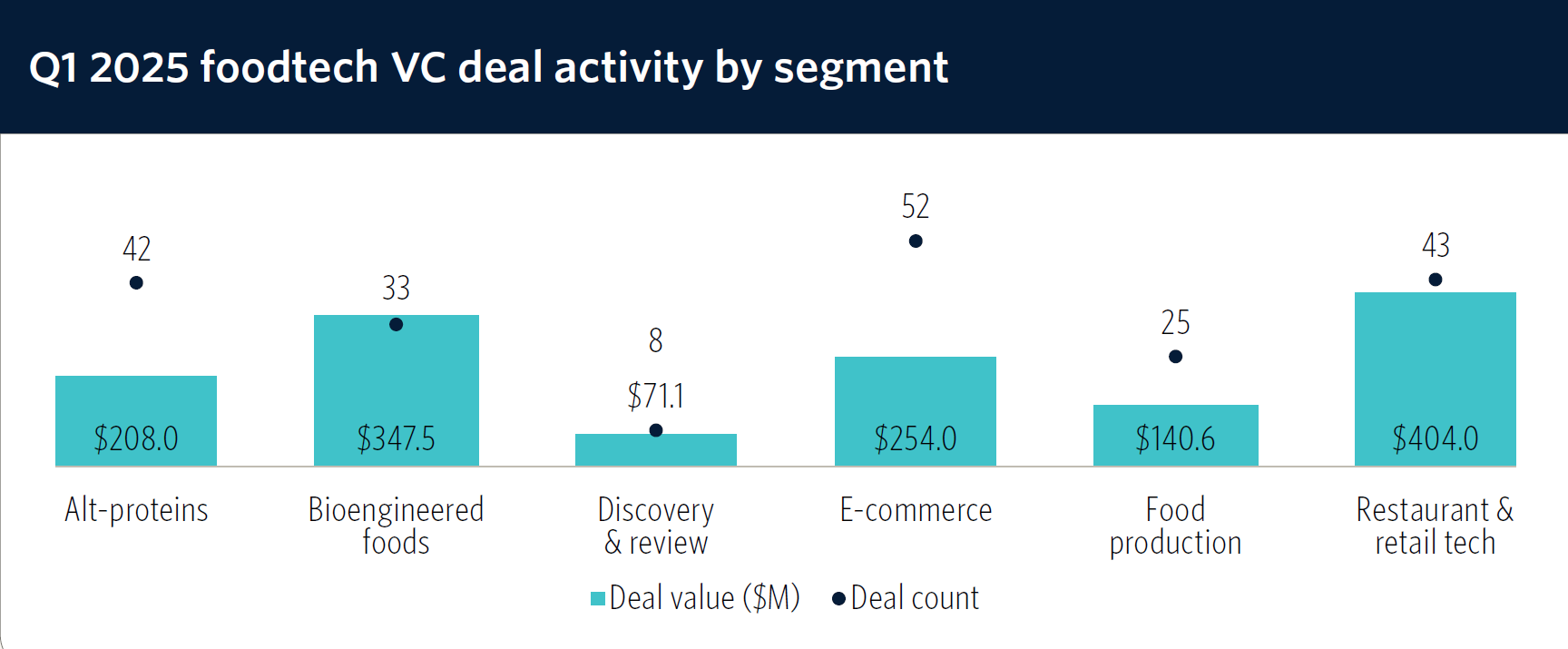

Foodtech VC activity slowed significantly in Q1, with $1.4 billion invested across 202 deals—a 36% drop in capital and a 18% drop in deal count vs Q1 2024 and a 49.6% in capital and 15.1% drop in deal count versus the previous quarter, according to new data from Pitchbook.

“Notably, some investors have pulled back from foodtech or from venture capital altogether,” says Pitchbook. “Investor caution remains elevated, with a marked shift toward more mature startups boasting proven business models. This has led to a sharp reduction in seed and early-stage funding.”

For startups, the environment is increasingly challenging, especially at the early stage, with median valuations dropping to $6.1 million in Q1, 2025 from $12.1 million in 2021, reflecting “tougher fundraising conditions and elevated expectations from investors,” says Pitchbook.

“Those unable to show near-term viability may struggle to secure funding or face pressure to accept lower valuations or alternative financing options such as venture debt.”

While 71% of all venture capital deployed in Q1 went to AI and machine learning startups, meanwhile, few AI-native foodtech startups closed major rounds, says Pitchbook.

“As capital increasingly gravitates toward AI, generalist investors may be overlooking attractive foodtech opportunities to get AI exposure. However, AI applications in restaurant management software, food intelligence & production, and supply chain traceability could reignite interest in the sector.”

Grounds for optimism?

Despite the slowdown, there were several notable deals during the quarter, with Tapcheck, an earned wage access platform for restaurants and retailers, raising a $250 million Series A and Dorsia, a membership platform for exclusive restaurant reservations, raising a $50.4 million Series A.

Augury and GrubMarket also closed rounds “without a valuation cut, bucking 2024’s trend of down rounds for maturing startups,” claims Pitchbook.

Despite grim news from mature alt protein companies such as Beyond Meat and Meati, early-stage dealmaking in alt-proteins also “remains robust, particularly in fermentation,” says Pitchbook, citing sizable rounds raised by firms including Liberation Bioindustries ($52 million), Vivici ($33.8 million), Aleph Farms ($29 million), and Project Eaden ($15.5 million).

Meanwhile, functional foods “emerged as one the strongest near-term opportunities in foodtech amid the broader funding downturn” says Pitchbook, highlighting Supergut’s $22 million Series B, hiyo’s $19 million Series A, Olipop’s $137.9 million Series C1, and Poppi’s $1.7 billion acquisition by PepsiCo, which “could spur further acquisitions as major brands look to expand their functional food portfolios.”

Exits

As for exits, public market volatility “kept the IPO window closed across Q1, leaving M&A as the primary exit route,” notes Pitchbook.

“We tracked 23 acquisitions of VC-backed foodtech companies in the quarter—not including the PepsiCo-Poppi deal, which is still in progress. Wonder made its fifth acquisition, purchasing Tastemade, a food-and-travel-focused media company.

“LG Electronics’ acquisition of Bear Robotics and DoorDash’s billion-dollar-plus acquisitions of Deliveroo and SevenRooms underscore ongoing consolidation and the expansion of delivery incumbents into broader restaurant operations.”